Chuyển sang chế độ ngoại tuyến với ứng dụng Player FM !

Money Talk Podcast, Friday Aug. 30, 2024

Manage episode 437240420 series 1036924

Advisors on this Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Aug. 26-30, 2024)

Significant Economic Indicators & Reports

Monday

Manufacturing demand rose in July for the fifth time in six months, mostly on the wings of increased commercial aircraft orders. The Commerce Department said durable goods orders rose 9.9% from June, though they fell 0.2% when transportation equipment was excluded. Compared to the year before, orders for long-lasting manufactured items were down 1.4% but up 1.4% excluding transportation. A measure of business investment, core capital goods orders, dipped 0.1% from June but rose 0.5% from July 2023.

Tuesday

Price increases for houses rose to a record level in June, though at a slower pace, according to the S&P CoreLogic Case-Shiller national index. Prices increased 0.2% from May, which had been up 03% from April, adjusting for inflation. Unadjusted, the price index rose 5.4% from June 2023, compared to a 5.9% 12-month gain in May. An analyst with the index noted that house prices continued to far outpace overall inflation – and at a wider gap than usual. The analyst said, adjusted for inflation, home prices have about doubled since 1974 and that lower-priced housing is becoming more expensive at a faster rate than other tiers in most markets.

Amid higher expectations for businesses and increased concerns about jobs and stocks, consumer confidence rose in August, though it stayed within a narrow range that has prevailed since 2022. The Conference Board reported that overall expectations fell below a level associated with recessions for the second month in a row. The business research group said that although consumers continued to complain about prices, their expectations for inflation were the lowest since March 2020. Consumer plans for homebuying reached a 12-year low.

Wednesday

No major releases

Thursday

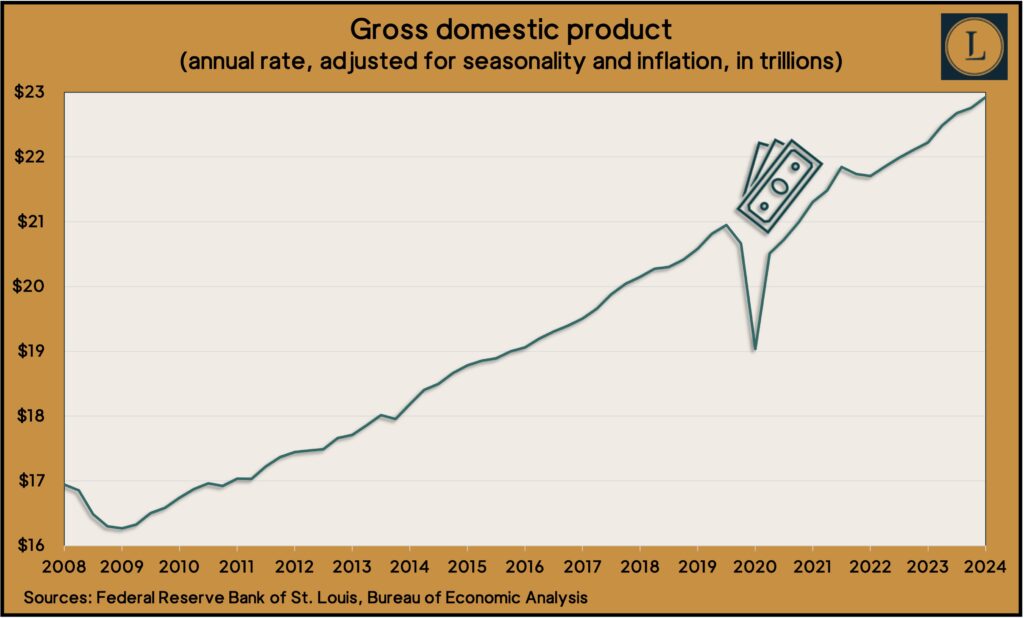

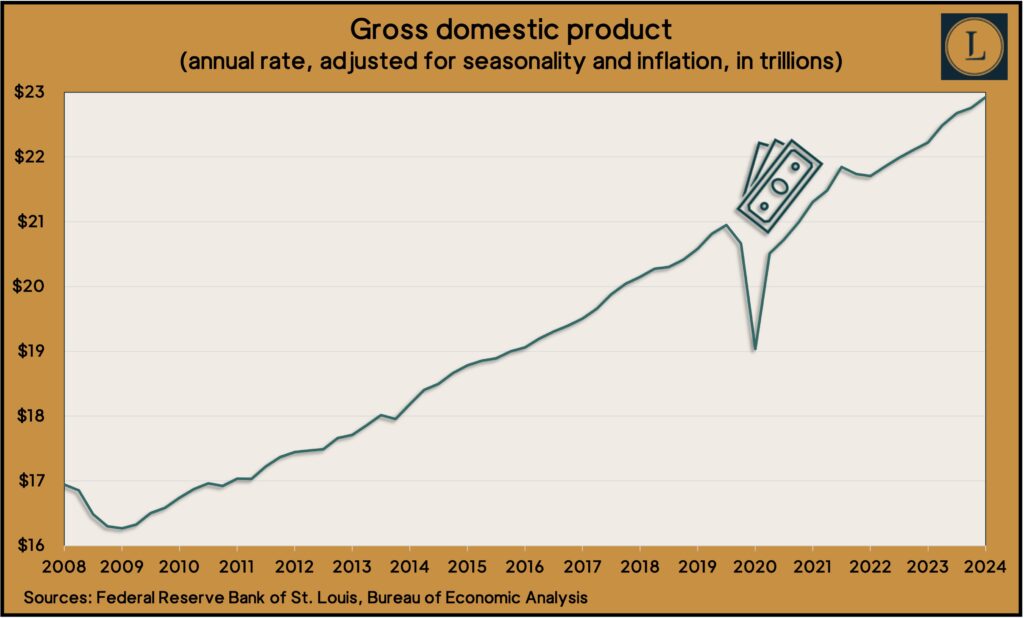

Because of brisker consumer spending in the second quarter, the U.S. economy grew at a 3% annual pace instead of an initial estimate of 2.8%. The Bureau of Economic Analysis said it revised the gross domestic product higher mostly because personal consumption – which accounts for about 70% of economic growth – rose at a 2.9% annual rate, up from a prior estimate of 2.3%. The Federal Reserve Board’s favorite measure of inflation, the Personal Consumption Expenditures index, rose at a pace of 2.5%, the slowest pace in more than three years.

The four-week moving average for initial unemployment claims fell for the third week in a row, suggesting continued reluctance by employers to let workers go. According to Labor Department data, new jobless claims reached their lowest level in 11 weeks and remained 36% below the 57-year average. Total claims fell 1.3% from the week before to just under 1.9 million, which was up 3% from the same time last year.

The National Association of Realtors said its pending home sales index sank in July to its lowest level in its 23 years. The trade association said prospects for sales dipped 5.5% from June and 8.5% from July 2023. The index reading was nearly 30% below the baseline on sales activity set in 2001. In a statement, the Realtors chief economist, Lawrence Yun, said: “The positive impact of job growth and higher inventory could not overcome affordability challenges and some degree of wait-and-see related to the upcoming U.S. presidential election.”

Friday

Personal spending rose a healthy 0.5% in July, the Bureau of Economic Analysis reported. The spending increase exceeded the month’s 0.3% gain in personal income, which meant the personal saving rate slowed to 2.9% of disposable income, the lowest since June 2022. The Fed’s favorite measure of inflation rose 2.5% from July 2023, the same pace as June and tied for the lowest rate in three years.

The University of Michigan said its consumer sentiment index rose for the first time in five months in August, as Americans took a slightly dimmer view of current economic conditions but broadly agreed that the long-term outlook had improved. The survey-based measure was 36% above its all-time low, reached in June 2022. It was 2% lower than in August 2023. A university economist noted that sentiment tends to tie closely with political affiliation. Sentiment is considered a bellwether for consumer spending.

Market Closings for the Week

- Nasdaq – 17714, down 164 points or 0.9%

- Standard & Poor’s 500 – 5648, up 14 points or 0.2%

- Dow Jones Industrial – 41563, up 388 points or 0.9%

- 10-year U.S. Treasury Note – 3.91%, up 0.10 point

137 tập

Manage episode 437240420 series 1036924

Advisors on this Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Aug. 26-30, 2024)

Significant Economic Indicators & Reports

Monday

Manufacturing demand rose in July for the fifth time in six months, mostly on the wings of increased commercial aircraft orders. The Commerce Department said durable goods orders rose 9.9% from June, though they fell 0.2% when transportation equipment was excluded. Compared to the year before, orders for long-lasting manufactured items were down 1.4% but up 1.4% excluding transportation. A measure of business investment, core capital goods orders, dipped 0.1% from June but rose 0.5% from July 2023.

Tuesday

Price increases for houses rose to a record level in June, though at a slower pace, according to the S&P CoreLogic Case-Shiller national index. Prices increased 0.2% from May, which had been up 03% from April, adjusting for inflation. Unadjusted, the price index rose 5.4% from June 2023, compared to a 5.9% 12-month gain in May. An analyst with the index noted that house prices continued to far outpace overall inflation – and at a wider gap than usual. The analyst said, adjusted for inflation, home prices have about doubled since 1974 and that lower-priced housing is becoming more expensive at a faster rate than other tiers in most markets.

Amid higher expectations for businesses and increased concerns about jobs and stocks, consumer confidence rose in August, though it stayed within a narrow range that has prevailed since 2022. The Conference Board reported that overall expectations fell below a level associated with recessions for the second month in a row. The business research group said that although consumers continued to complain about prices, their expectations for inflation were the lowest since March 2020. Consumer plans for homebuying reached a 12-year low.

Wednesday

No major releases

Thursday

Because of brisker consumer spending in the second quarter, the U.S. economy grew at a 3% annual pace instead of an initial estimate of 2.8%. The Bureau of Economic Analysis said it revised the gross domestic product higher mostly because personal consumption – which accounts for about 70% of economic growth – rose at a 2.9% annual rate, up from a prior estimate of 2.3%. The Federal Reserve Board’s favorite measure of inflation, the Personal Consumption Expenditures index, rose at a pace of 2.5%, the slowest pace in more than three years.

The four-week moving average for initial unemployment claims fell for the third week in a row, suggesting continued reluctance by employers to let workers go. According to Labor Department data, new jobless claims reached their lowest level in 11 weeks and remained 36% below the 57-year average. Total claims fell 1.3% from the week before to just under 1.9 million, which was up 3% from the same time last year.

The National Association of Realtors said its pending home sales index sank in July to its lowest level in its 23 years. The trade association said prospects for sales dipped 5.5% from June and 8.5% from July 2023. The index reading was nearly 30% below the baseline on sales activity set in 2001. In a statement, the Realtors chief economist, Lawrence Yun, said: “The positive impact of job growth and higher inventory could not overcome affordability challenges and some degree of wait-and-see related to the upcoming U.S. presidential election.”

Friday

Personal spending rose a healthy 0.5% in July, the Bureau of Economic Analysis reported. The spending increase exceeded the month’s 0.3% gain in personal income, which meant the personal saving rate slowed to 2.9% of disposable income, the lowest since June 2022. The Fed’s favorite measure of inflation rose 2.5% from July 2023, the same pace as June and tied for the lowest rate in three years.

The University of Michigan said its consumer sentiment index rose for the first time in five months in August, as Americans took a slightly dimmer view of current economic conditions but broadly agreed that the long-term outlook had improved. The survey-based measure was 36% above its all-time low, reached in June 2022. It was 2% lower than in August 2023. A university economist noted that sentiment tends to tie closely with political affiliation. Sentiment is considered a bellwether for consumer spending.

Market Closings for the Week

- Nasdaq – 17714, down 164 points or 0.9%

- Standard & Poor’s 500 – 5648, up 14 points or 0.2%

- Dow Jones Industrial – 41563, up 388 points or 0.9%

- 10-year U.S. Treasury Note – 3.91%, up 0.10 point

137 tập

Tất cả các tập

×Chào mừng bạn đến với Player FM!

Player FM đang quét trang web để tìm các podcast chất lượng cao cho bạn thưởng thức ngay bây giờ. Đây là ứng dụng podcast tốt nhất và hoạt động trên Android, iPhone và web. Đăng ký để đồng bộ các theo dõi trên tất cả thiết bị.