The Greatness Machine is on a Quest to Maximize the Human Experience! Join Award Winning CEO and Author, Darius Mirshahzadeh (pron. Mer-shaw-za-day), as he interviews some of the greatest minds in the world―turning their wisdom and experience into learnings and advice you can use in your life so that you can level up and create greatness. Join Darius as he goes deep with guests like: Moby, Seth Godin, Gabby Reece, Amanda Knox, UFC Ring Announcer Bruce Buffer, Former FBI Negotiator Chris Voss ...

…

continue reading

Nội dung được cung cấp bởi Not Your Average Financial Podcast™. Tất cả nội dung podcast bao gồm các tập, đồ họa và mô tả podcast đều được Not Your Average Financial Podcast™ hoặc đối tác nền tảng podcast của họ tải lên và cung cấp trực tiếp. Nếu bạn cho rằng ai đó đang sử dụng tác phẩm có bản quyền của bạn mà không có sự cho phép của bạn, bạn có thể làm theo quy trình được nêu ở đây https://vi.player.fm/legal.

Player FM - Ứng dụng Podcast

Chuyển sang chế độ ngoại tuyến với ứng dụng Player FM !

Chuyển sang chế độ ngoại tuyến với ứng dụng Player FM !

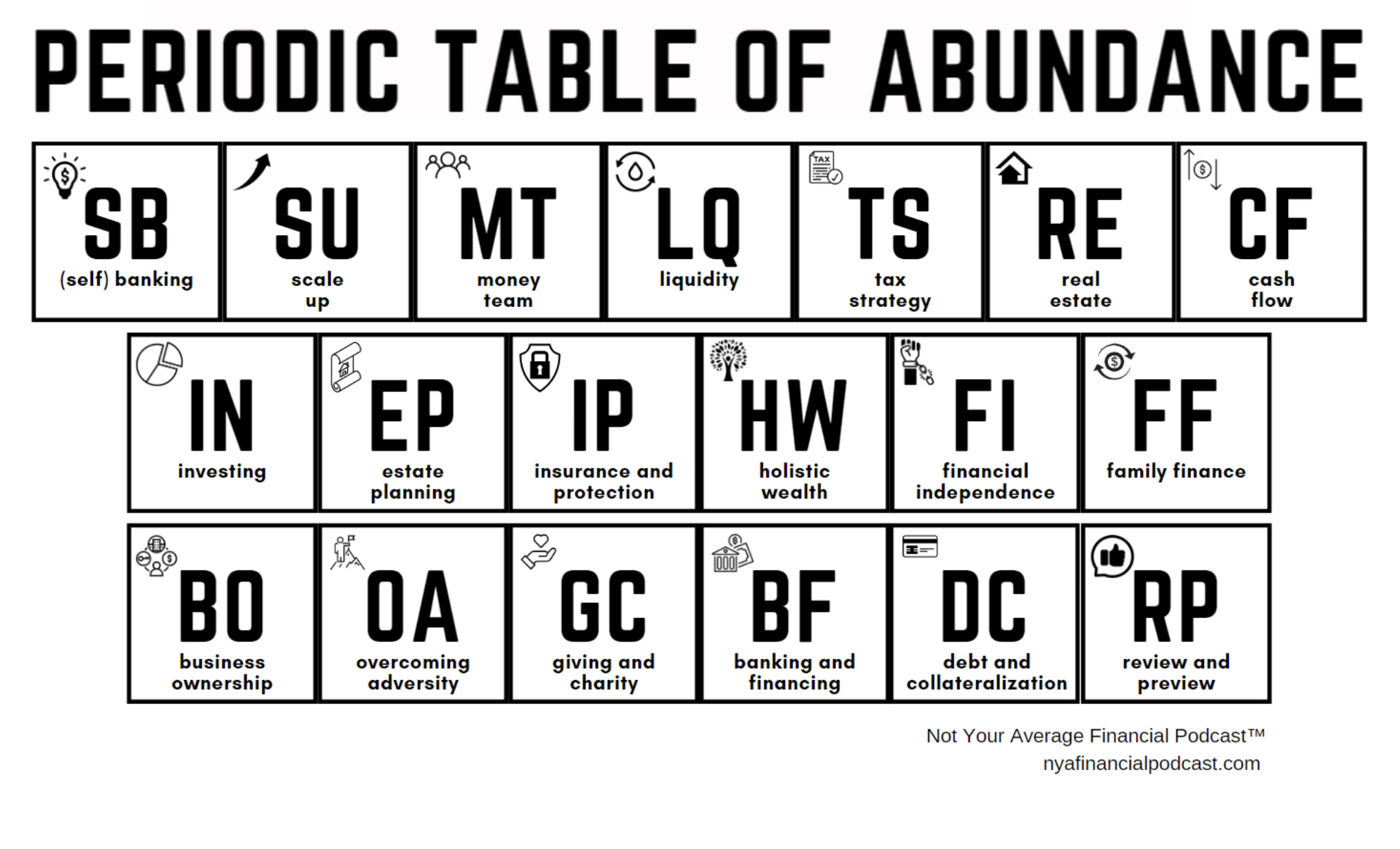

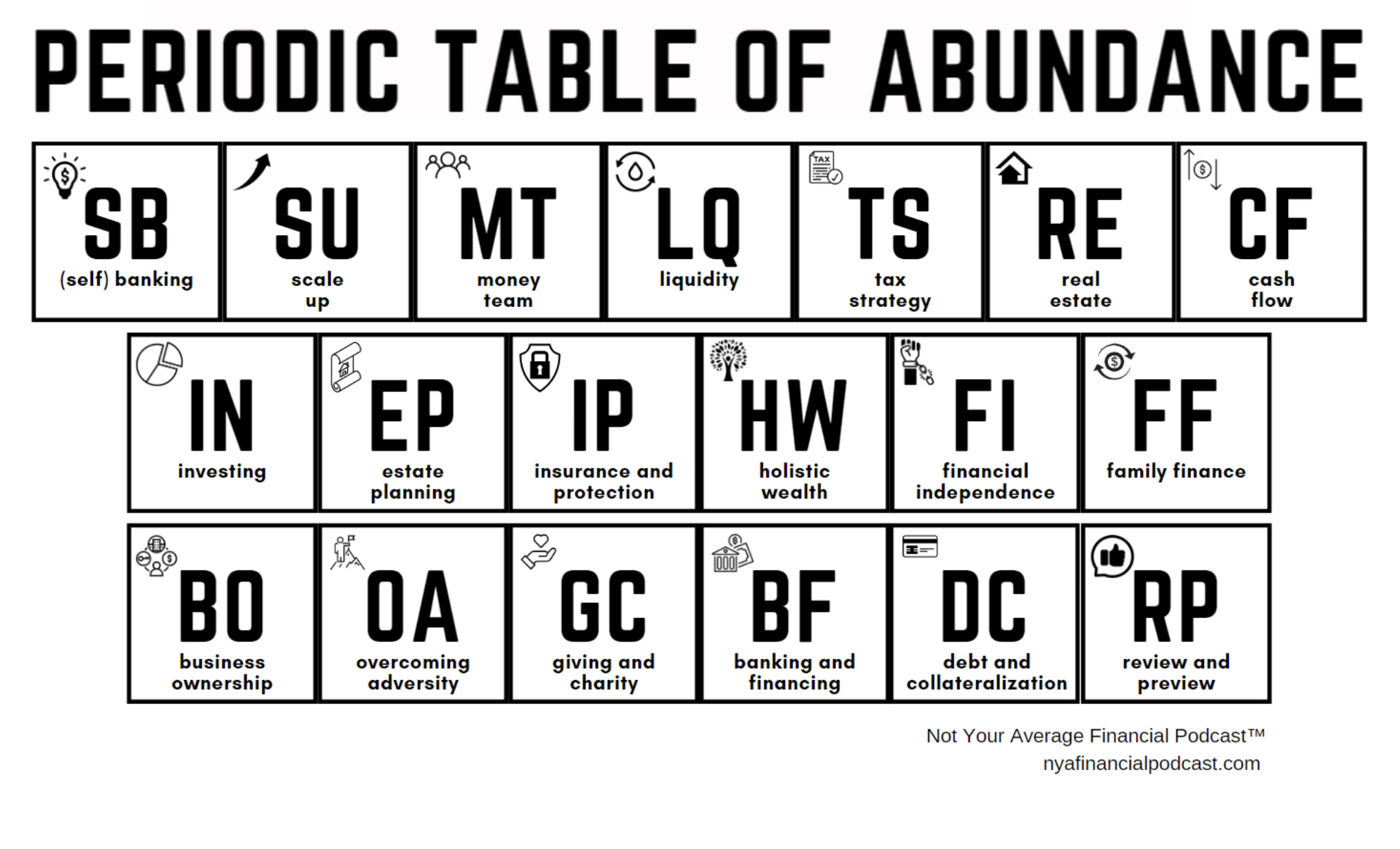

Episode 336: [Periodic Table of Abundance] No.7 Financial Independence and the Magic of Collateralization

Manage episode 400034983 series 1610796

Nội dung được cung cấp bởi Not Your Average Financial Podcast™. Tất cả nội dung podcast bao gồm các tập, đồ họa và mô tả podcast đều được Not Your Average Financial Podcast™ hoặc đối tác nền tảng podcast của họ tải lên và cung cấp trực tiếp. Nếu bạn cho rằng ai đó đang sử dụng tác phẩm có bản quyền của bạn mà không có sự cho phép của bạn, bạn có thể làm theo quy trình được nêu ở đây https://vi.player.fm/legal.

In this episode, we ask:

- Would you like to get the special report on the Periodic Table of Abundance? Would you like to Request a Meeting?

- Have you listened to the previous episodes in this series?

- Would you like to hear Episode 330: No.1 Scaling Up and Overcoming Adversity?

- Would you like to hear Episode 331: No.2 Money Team, Family Finance and Estate Planning?

- Would you like to hear Episode 332: No.3 Liquidity and Cash Flow?

- Would you like to hear Episode 333: No.4 Secrets of Leverage with Insurance and Banking?

- Would you like to hear Episode 334: No.5 Achieve Your Ultimate Potential with Investing and Real Estate

- Would you like to hear Episode 335: No.6 Building a Better World Through Business Ownership, Tax Strategy and Giving

- What is financial independence?

- Would you like to learn about financial independence?

- Would you like to learn about the power of financial collateralization?

- Do you have enough passive income to cover your expenses?

- Do you have to depend on your active income?

- Do you have streams of income to replace your day job?

- What are your expenses?

- What are the stages?

- Do you have an emergency?

- Why did we choose one year for an emergency?

- What about placing your emergency fund in a Bank On Yourself® type whole life insurance policy?

- What about passive income exceeding earned income?

- Would you like to run the financial independence calculator with Mark or a colleague?

- What would it take to cover a luxury item?

- What about changing the world through philanthropy?

- What about the journey?

- What about Odysseus?

- What about freedom?

- What did Nietzsche say?

- What about Frodo?

- What about Iron Man?

- What about Luke?

- What are most financial advisors up to?

- What do you want?

- What are the five mile posts?

- What is basecamp?

- What about reducing your expenses or increasing your income?

- Would you like to hear Episode 19?

- Would you like to hear Episode 63?

- What does Parkinson’s law of finance say?

- What about being honest with money?

- What about investing in yourself?

- What about your education?

- What about your health?

- Are you a better version of yourself?

- Do you have an idea of what you will be doing?

- How do you expect to be in a different place a year from now?

- What is the greatest challenge you’re facing right now?

- What have you tried in the past?

- What are you going to do next?

- …By when?

- What about liquidity?

- What will you do in an emergency?

- Do you budget?

- Do you save in liquid form?

- Who has a financially unstable pyramid?

- Who is putting all of their money at risk?

- Is your money liquid?

- Is your money available to you?

- Who does this benefit?

- Could you cover an emergency expense of $400?

- Do you need to sell your stuff?

- Why not build a stable financial structure?

- What did Tim Austin say about the 10/10/10 rule?

- Who is saving 30% of income each month?

- Now that I’m saving, where do I save it?

- Is your money stashed in the right place?

- What about CDs?

- What is taxable?

- What are you really earning after taxes?

- What about interest rates on (multi-year guaranteed annuities) MYGAs?

- What about Bank on Yourself® type whole life insurance policies?

- What about the power of collateralization?

- What about cash value?

- Would you like to hear Episode 32?

- What about investing in things you understand and control?

- What do you need to quit?

- Do you need a rental property?

- Do you need to borrow against your life insurance policy?

- What can you control?

- What are you into?

- Where can you put your money to work?

- How might you create multiple streams of passive income?

- How might you buy multiple streams of passive income?

- What could you do to add one more stream?

- Can you outspend any income?

- What about mentoring?

- Are you the guide?

- What do you have to share with the world?

- How are you writing your story?

- How many pages do you have left?

- Would you like to like to meet with Mark?

332 tập

Manage episode 400034983 series 1610796

Nội dung được cung cấp bởi Not Your Average Financial Podcast™. Tất cả nội dung podcast bao gồm các tập, đồ họa và mô tả podcast đều được Not Your Average Financial Podcast™ hoặc đối tác nền tảng podcast của họ tải lên và cung cấp trực tiếp. Nếu bạn cho rằng ai đó đang sử dụng tác phẩm có bản quyền của bạn mà không có sự cho phép của bạn, bạn có thể làm theo quy trình được nêu ở đây https://vi.player.fm/legal.

In this episode, we ask:

- Would you like to get the special report on the Periodic Table of Abundance? Would you like to Request a Meeting?

- Have you listened to the previous episodes in this series?

- Would you like to hear Episode 330: No.1 Scaling Up and Overcoming Adversity?

- Would you like to hear Episode 331: No.2 Money Team, Family Finance and Estate Planning?

- Would you like to hear Episode 332: No.3 Liquidity and Cash Flow?

- Would you like to hear Episode 333: No.4 Secrets of Leverage with Insurance and Banking?

- Would you like to hear Episode 334: No.5 Achieve Your Ultimate Potential with Investing and Real Estate

- Would you like to hear Episode 335: No.6 Building a Better World Through Business Ownership, Tax Strategy and Giving

- What is financial independence?

- Would you like to learn about financial independence?

- Would you like to learn about the power of financial collateralization?

- Do you have enough passive income to cover your expenses?

- Do you have to depend on your active income?

- Do you have streams of income to replace your day job?

- What are your expenses?

- What are the stages?

- Do you have an emergency?

- Why did we choose one year for an emergency?

- What about placing your emergency fund in a Bank On Yourself® type whole life insurance policy?

- What about passive income exceeding earned income?

- Would you like to run the financial independence calculator with Mark or a colleague?

- What would it take to cover a luxury item?

- What about changing the world through philanthropy?

- What about the journey?

- What about Odysseus?

- What about freedom?

- What did Nietzsche say?

- What about Frodo?

- What about Iron Man?

- What about Luke?

- What are most financial advisors up to?

- What do you want?

- What are the five mile posts?

- What is basecamp?

- What about reducing your expenses or increasing your income?

- Would you like to hear Episode 19?

- Would you like to hear Episode 63?

- What does Parkinson’s law of finance say?

- What about being honest with money?

- What about investing in yourself?

- What about your education?

- What about your health?

- Are you a better version of yourself?

- Do you have an idea of what you will be doing?

- How do you expect to be in a different place a year from now?

- What is the greatest challenge you’re facing right now?

- What have you tried in the past?

- What are you going to do next?

- …By when?

- What about liquidity?

- What will you do in an emergency?

- Do you budget?

- Do you save in liquid form?

- Who has a financially unstable pyramid?

- Who is putting all of their money at risk?

- Is your money liquid?

- Is your money available to you?

- Who does this benefit?

- Could you cover an emergency expense of $400?

- Do you need to sell your stuff?

- Why not build a stable financial structure?

- What did Tim Austin say about the 10/10/10 rule?

- Who is saving 30% of income each month?

- Now that I’m saving, where do I save it?

- Is your money stashed in the right place?

- What about CDs?

- What is taxable?

- What are you really earning after taxes?

- What about interest rates on (multi-year guaranteed annuities) MYGAs?

- What about Bank on Yourself® type whole life insurance policies?

- What about the power of collateralization?

- What about cash value?

- Would you like to hear Episode 32?

- What about investing in things you understand and control?

- What do you need to quit?

- Do you need a rental property?

- Do you need to borrow against your life insurance policy?

- What can you control?

- What are you into?

- Where can you put your money to work?

- How might you create multiple streams of passive income?

- How might you buy multiple streams of passive income?

- What could you do to add one more stream?

- Can you outspend any income?

- What about mentoring?

- Are you the guide?

- What do you have to share with the world?

- How are you writing your story?

- How many pages do you have left?

- Would you like to like to meet with Mark?

332 tập

Tất cả các tập

×Chào mừng bạn đến với Player FM!

Player FM đang quét trang web để tìm các podcast chất lượng cao cho bạn thưởng thức ngay bây giờ. Đây là ứng dụng podcast tốt nhất và hoạt động trên Android, iPhone và web. Đăng ký để đồng bộ các theo dõi trên tất cả thiết bị.