Chuyển sang chế độ ngoại tuyến với ứng dụng Player FM !

Shifting Trends: Credit Cards and P2P Payments Take Center Stage

Manage episode 455798847 series 3046334

Financial institutions are exploring new ways to attract younger savers, and their payment habits are evolving in turn. Credit cards have now edged out debit cards as the preferred choice, even among younger generations. Additionally, digital wallets and peer-to-peer methods like Venmo and PayPal are gaining significant traction in this demographic.

Velera’s Eye on Payments study, a comprehensive annual assessment of payment choices among credit union members and other financial institutions, examines how these trends shift over time. Now in its seventh year, the research delves into the factors shaping consumer choices across various payment methods, with a particular focus on how these preferences evolve at different life stages.

In a recent PaymentsJournal podcast, Velera’s Tom Pierce, Chief Marketing & Communications Officer, and Norm Patrick, Vice President of Velera’s Advisors Plus, discussed the findings from this year’s survey with Brian Riley, Co-Head of Payments for Javelin Strategy & Research. They also explored how credit unions can leverage these insights to better serve their members.

Credit Over Debit

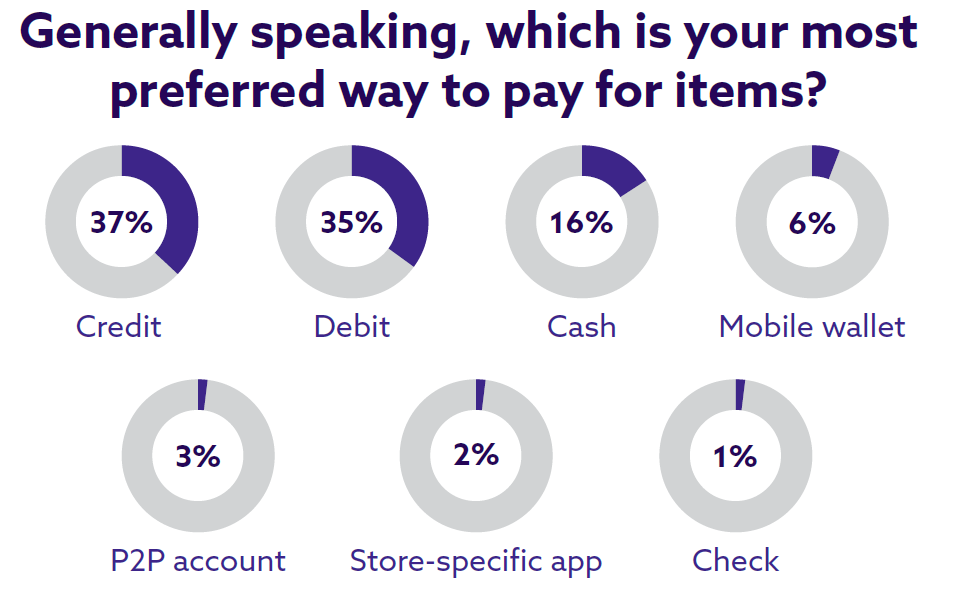

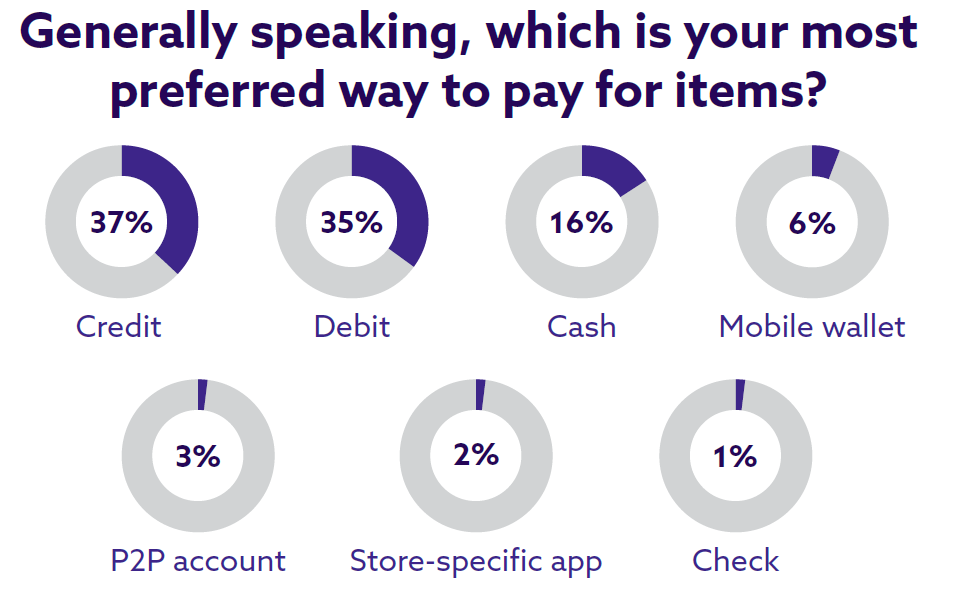

After five years of debit cards dominating payment preferences, Velera’s research reveals a notable shift toward credit. This year, 37% of respondents indicated a preference for using credit at the point of sale, surpassing debit at 35%. Relatedly, 40% of credit union members reported applying for a credit card within the past year.

Source: Velera’s Eye on Payments 2024 report

Among younger demographics, the trend is even more pronounced. Half of both older and younger millennials, as well as Gen Z respondents, stated that they had applied for a credit card in the last 12 months. Velera’s findings show a 40% preference for credit as the primary payment method within these younger age groups.

“That generational flip is really important in the credit union industry because of the aging membership,” said Riley. “Being able to react and have the right offerings in place for the younger generations is something that’s essential for credit unions.”

Other Payment Methods

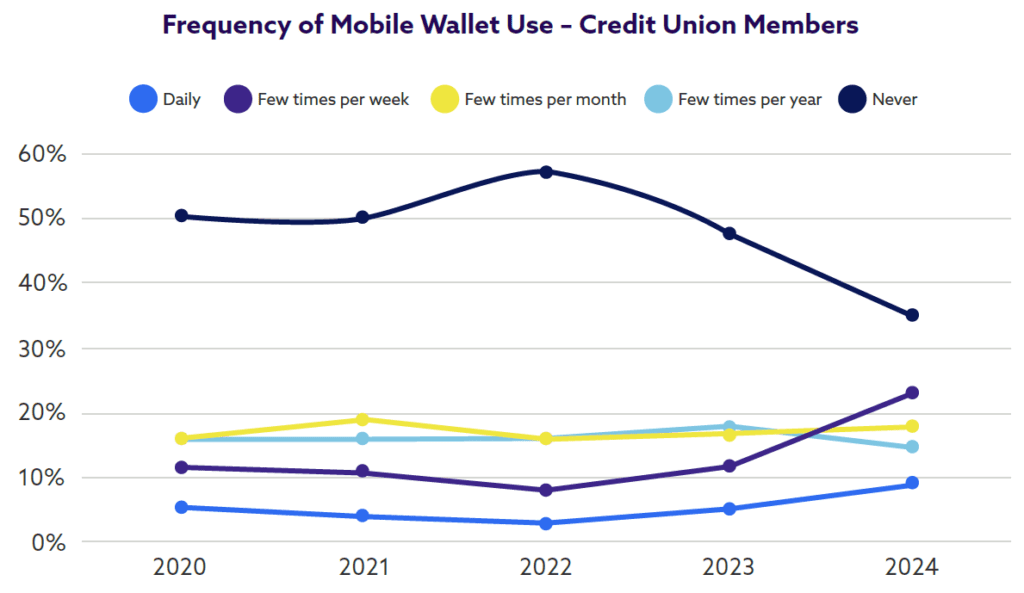

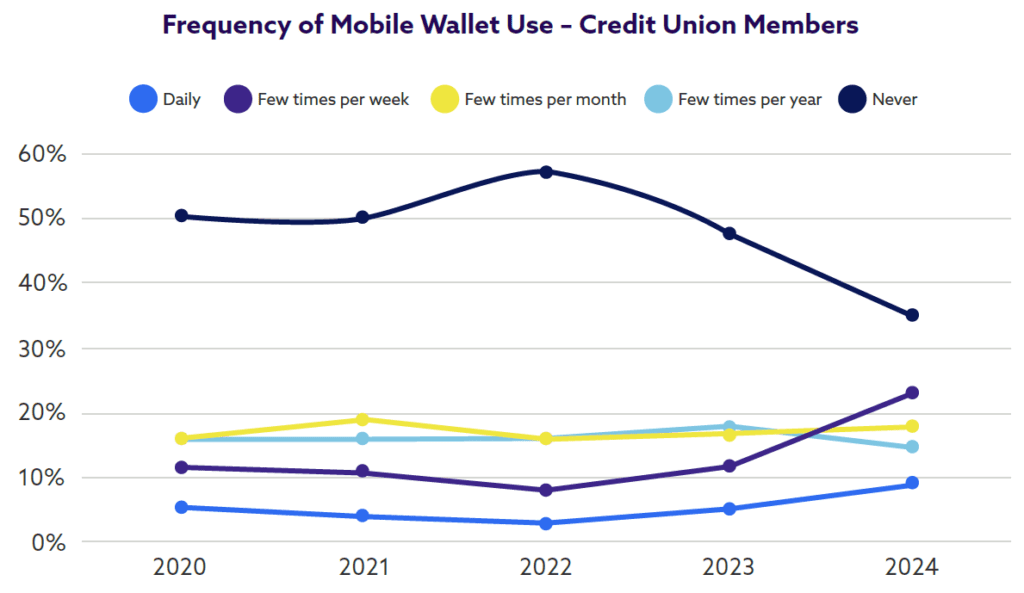

Mobile wallet usage has seen a significant surge in recent years. The percentage of respondents using a mobile wallet at least a couple of times a month jumped from 27% in 2022 to 34% in 2023, and this year, that figure rose to 50%. Overall, about 60% of credit union members plan to implement mobile wallets within the next six months. Not surprisingly, the lion’s share of this activity is driven by younger consumers.

Source: Velera’s Eye on Payments 2024 report

This demographic also expresses strong concerns about fraud and identity theft, highlighting the importance of engaging with them to build trust and increase their comfort with the fraud prevention tools issuers offer.

Another payment method that has experienced a substantial increase is peer-to-peer (P2P) payments. Just 12% of respondents reported using P2P as a primary payment method in 2023, but that number more than doubled in 2024, rising to 25%.

“As we look at the younger generations, there are a lot more people who are using P2P as a primary method,” said Patrick. “It’s important that they be educated with the ins and outs of using those different solutions. When you have money sitting in your Venmo account, it is outside of the financial institution. It may not be insured, and it may not be a fraud check for losses.

“With the boomer generation, there isn’t a ton of interest in P2P,” he said. “In fact, 62% of those surveyed said they do not use P2P type of methods at all. But that means that there is some that do, and there could be some opportunity to encourage them to do more.”

Design for Living

Card design is also top-of-mind. In fact, more than half of credit union members said that card design influences what type of card they choose to use on a regular basis.

“That was up from 39% last year, and we were pretty amazed with the number last year,” said Pierce. “It seemingly has taken place overnight.”

These design preferences can include various factors, such as the material of the card, its overall design and whether it offers contactless payment capabilities. Is it made from sustainable materials? Is it sleek? Or perhaps an affinity card that showcases their favorite sports team?

Card design is an especially important consideration for younger consumers. Among Gen Z respondents, 82% indicated that the design of the card was a key factor in their decision-making.

“At the end of the day, it’s a billboard for the financial institution,” said Riley. “It’s important to have that card engineered properly with a good-looking design, and have all the features that you’d expect, such as chip and pin and the contactless tie-in.”

Taking a Holistic View

Given the growth in credit card usage, it’s an important time for credit unions to look at their card programs holistically. Credit unions are increasingly targeting younger generations, and more than half of this group said they applied for a credit card in the past 12 months.

“How easy is it at your credit union to apply for a new card?” asked Pierce. “You’ve got to look closely at that and make sure you have a quick and effective origination process. Offering a good reward structure and customizing that card so it appeals to a wide range of age groups is also essential. And certainly, tying back to the younger group is an urgent need across the board.”

For more of these insights and to see the full results of the study, DOWNLOAD THE WHITE PAPER at Velera.com.

The post Shifting Trends: Credit Cards and P2P Payments Take Center Stage appeared first on PaymentsJournal.

26 tập

Manage episode 455798847 series 3046334

Financial institutions are exploring new ways to attract younger savers, and their payment habits are evolving in turn. Credit cards have now edged out debit cards as the preferred choice, even among younger generations. Additionally, digital wallets and peer-to-peer methods like Venmo and PayPal are gaining significant traction in this demographic.

Velera’s Eye on Payments study, a comprehensive annual assessment of payment choices among credit union members and other financial institutions, examines how these trends shift over time. Now in its seventh year, the research delves into the factors shaping consumer choices across various payment methods, with a particular focus on how these preferences evolve at different life stages.

In a recent PaymentsJournal podcast, Velera’s Tom Pierce, Chief Marketing & Communications Officer, and Norm Patrick, Vice President of Velera’s Advisors Plus, discussed the findings from this year’s survey with Brian Riley, Co-Head of Payments for Javelin Strategy & Research. They also explored how credit unions can leverage these insights to better serve their members.

Credit Over Debit

After five years of debit cards dominating payment preferences, Velera’s research reveals a notable shift toward credit. This year, 37% of respondents indicated a preference for using credit at the point of sale, surpassing debit at 35%. Relatedly, 40% of credit union members reported applying for a credit card within the past year.

Source: Velera’s Eye on Payments 2024 report

Among younger demographics, the trend is even more pronounced. Half of both older and younger millennials, as well as Gen Z respondents, stated that they had applied for a credit card in the last 12 months. Velera’s findings show a 40% preference for credit as the primary payment method within these younger age groups.

“That generational flip is really important in the credit union industry because of the aging membership,” said Riley. “Being able to react and have the right offerings in place for the younger generations is something that’s essential for credit unions.”

Other Payment Methods

Mobile wallet usage has seen a significant surge in recent years. The percentage of respondents using a mobile wallet at least a couple of times a month jumped from 27% in 2022 to 34% in 2023, and this year, that figure rose to 50%. Overall, about 60% of credit union members plan to implement mobile wallets within the next six months. Not surprisingly, the lion’s share of this activity is driven by younger consumers.

Source: Velera’s Eye on Payments 2024 report

This demographic also expresses strong concerns about fraud and identity theft, highlighting the importance of engaging with them to build trust and increase their comfort with the fraud prevention tools issuers offer.

Another payment method that has experienced a substantial increase is peer-to-peer (P2P) payments. Just 12% of respondents reported using P2P as a primary payment method in 2023, but that number more than doubled in 2024, rising to 25%.

“As we look at the younger generations, there are a lot more people who are using P2P as a primary method,” said Patrick. “It’s important that they be educated with the ins and outs of using those different solutions. When you have money sitting in your Venmo account, it is outside of the financial institution. It may not be insured, and it may not be a fraud check for losses.

“With the boomer generation, there isn’t a ton of interest in P2P,” he said. “In fact, 62% of those surveyed said they do not use P2P type of methods at all. But that means that there is some that do, and there could be some opportunity to encourage them to do more.”

Design for Living

Card design is also top-of-mind. In fact, more than half of credit union members said that card design influences what type of card they choose to use on a regular basis.

“That was up from 39% last year, and we were pretty amazed with the number last year,” said Pierce. “It seemingly has taken place overnight.”

These design preferences can include various factors, such as the material of the card, its overall design and whether it offers contactless payment capabilities. Is it made from sustainable materials? Is it sleek? Or perhaps an affinity card that showcases their favorite sports team?

Card design is an especially important consideration for younger consumers. Among Gen Z respondents, 82% indicated that the design of the card was a key factor in their decision-making.

“At the end of the day, it’s a billboard for the financial institution,” said Riley. “It’s important to have that card engineered properly with a good-looking design, and have all the features that you’d expect, such as chip and pin and the contactless tie-in.”

Taking a Holistic View

Given the growth in credit card usage, it’s an important time for credit unions to look at their card programs holistically. Credit unions are increasingly targeting younger generations, and more than half of this group said they applied for a credit card in the past 12 months.

“How easy is it at your credit union to apply for a new card?” asked Pierce. “You’ve got to look closely at that and make sure you have a quick and effective origination process. Offering a good reward structure and customizing that card so it appeals to a wide range of age groups is also essential. And certainly, tying back to the younger group is an urgent need across the board.”

For more of these insights and to see the full results of the study, DOWNLOAD THE WHITE PAPER at Velera.com.

The post Shifting Trends: Credit Cards and P2P Payments Take Center Stage appeared first on PaymentsJournal.

26 tập

सभी एपिसोड

×Chào mừng bạn đến với Player FM!

Player FM đang quét trang web để tìm các podcast chất lượng cao cho bạn thưởng thức ngay bây giờ. Đây là ứng dụng podcast tốt nhất và hoạt động trên Android, iPhone và web. Đăng ký để đồng bộ các theo dõi trên tất cả thiết bị.